| 1. Local Currency - reserved field for the local currency of the company |

| 2. Country Code - reserved field for the local country code of the company |

| 3. GST% - default percentage used in computing such taxes of the company |

| 4. GST Reg No - company GST Reg No |

| 5. ROC No - reserved field for ROC No of the company |

| 6. CPF No - reserved field for CPF No of the company |

| 7. IR8A No - reserved field for the IR8A No of the company |

| 8. Inc Tax No - reserved field for the income tax no of the company |

| 9. Employer Reference No - reserved field for the employer reference no |

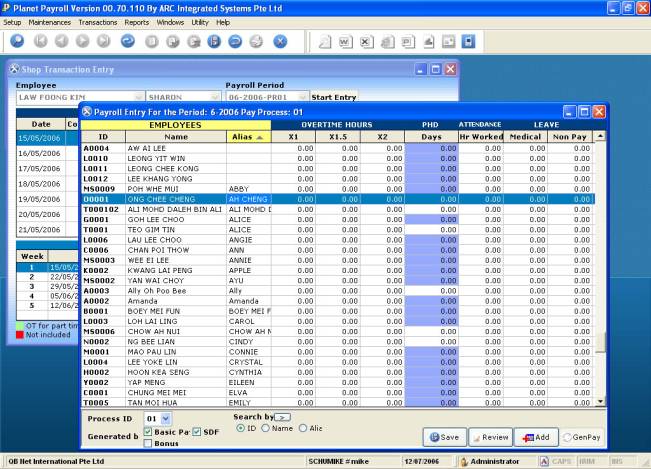

| 10. Shop Days Cut OFF - this days are used in the shop transaction entry,

whereby if value is equal to zero (0) by default, 15th day is the cut off |

| 11. Hourly Rate Round Off - used in the rounding off of getting the hourly

rate based from basic pay x 12 / (52 * Hours per week) |

| 12. No Work Days - used in getting the Monthly Working Days computation and also used in the generating the payroll for the period whereby employees that joined in the middle of the month and prorating it by its working days |

| 13. Month Current Period - used upon the creation of a payroll period, so

by every payroll period this is being changed as month and year changes |

| 14. Year Current Period - same as with Month Current Period |

| 15. Month Year End - reserved field for the company�fs month end payroll cycle |

| 16. Year End - reserved field for the company�fs year end payroll cycle |

| 17. EE CD Running No. - reserved field for the company�fs EE CD Running No. |

| 18. SDF% - used when an SDF applies for a particular employee if so, this is computed based from the Gross pay computation |

| 19. SDF Limit Low - is the low value of SDF where if gross belongs in between

the Low and High SDF then it will be multiplied to the SDF% |

| 20. SDF Limit High - is the high value of SDF where if gross belongs in between

the Low and High SDF then it will be multiplied to the SDF% |